owe state taxes how to pay

If you dont make acceptable payment arrangements andor dont make the. Or you can have a direct debit from your bank account by.

Dor Owe State Taxes Here Are Your Payment Options

To create an account as an individual you will need your SSN and you state AGI.

. Do I Owe State Taxes. You can either pay once a year when you file your state. Direct Payment To initiate your payment choose either Checking or Savings and then enter the.

Use tax is owed by April 15th the year after you make a purchase for which California tax was not charged. Pay your bill or notice Pay personal income tax owed with your return Pay income tax through Online Services regardless of how you file your return. How do I pay the tax due.

Write the type of tax being paid and the tax year being paid on the. 15 the total tax due per month. As you pay your tax bill another thing to consider is using a tax-filing service that lets you pay your taxes by credit card.

Pay Collections Make a payment Bank account Credit card Payment plan More payment options You may be required to pay electronically. Pay a Bill Pay a Bill To pay a bill received by mail you will need the Letter ID and Account Number. Determine how much you can afford per month in total and offer to pay a proportionate amount to each agency out of that money.

The best way to figure out if you owe taxes is to complete your tax forms completely. Mail your return and payment to. The amount of state and local income tax you pay will depend on how much income you earn and the tax rate of the state or locality where you live.

28 2022 421 PM PT. You might owe state taxes because you have a different personal tax situation. Failure to file or pay Estimated Taxes.

You will enter your income deductions and credits. You can pay or schedule a. Your average tax rate is 1198 and your marginal.

After verifying your information select next at the bottom of the screen to proceed. Its base sales tax rate of 725 is higher than that of any other state and its top marginal income tax rate of 133 is the highest state. You are leaving ftbcagov.

You can pay by check or money order with a payment voucher Form 1040-V that you print and mail to the IRS. Why does Turbotax say I owe state tax. For example if you owe 5000 to the Internal Revenue Service.

Payment Options Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent at 1-877-252-3252. State Tax Due means that the taxes withheld from your wages. California has among the highest taxes in the nation.

The Department of Revenue will always attempt to work with you in order to pay your debt but you must contact us. Usually if you got a refund the previous year you should be. You can pay your Individual Maryland taxes with a personal check or money order if you prefer not to pay electronically or with a credit card.

Visit Mandatory e-Pay What you may owe You filed. To find out how much. If including payment of taxes owed when mailing your Indiana income tax return print your SSN and tax year on the check or money order.

Help is available if you owe taxes but cant pay in full. California Income Tax Calculator 2021. Mail a check or money order with an IA 1040V Payment Voucher payable to Iowa Department of Revenue.

Personal and Business Income Taxes Residents Non-residents State of California. If you file electronically and pay by check or. It amounts to 5 the tax due per month and cant exceed 50 of the total tax due.

As in the case with the IRS if you fail to pay state taxes owed. Why Do I Owe State Taxes. For tax years 2014 through 2016 the.

You will also report how much. Cant pay your taxes. That way you can at least get valuable credit card.

The amount of income tax money owed but not paid to the IRS is projected to grow the agency said Friday. If you make 70000 a year living in the region of California USA you will be taxed 15111.

Multiple States Figuring What S Owed When You Live And Work In More Than One State Turbotax Tax Tips Videos

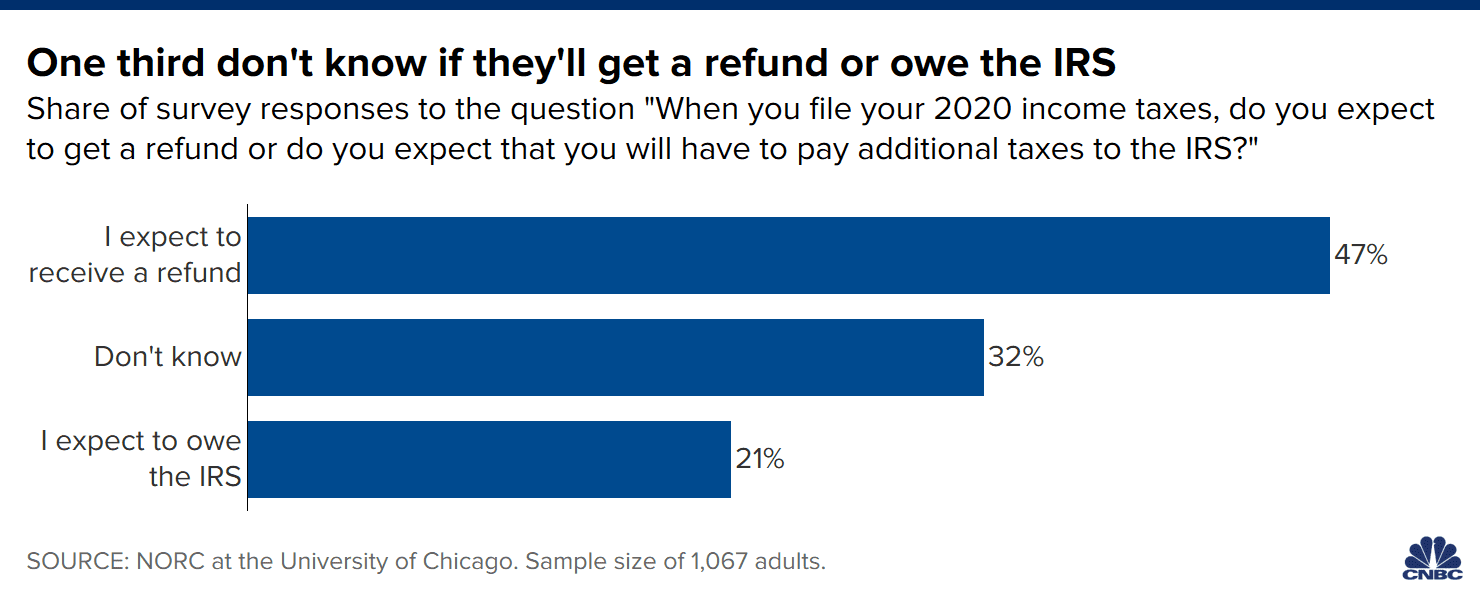

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

What To Do If You Owe The Irs Back Taxes H R Block

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

What Are Employer Taxes And Employee Taxes Gusto

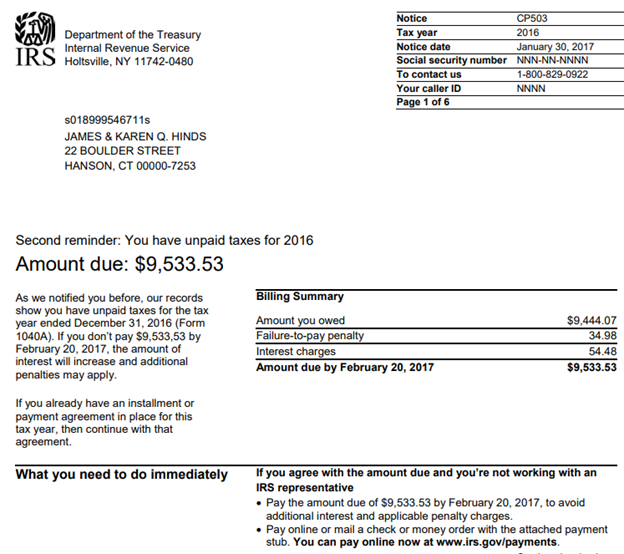

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

School District Income Tax Department Of Taxation

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Irs Finds Growing Gap In Income Taxes Owed Taxes Paid Newsmax Com

How Az Tax Credit Work If You Don T Owe Taxes

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

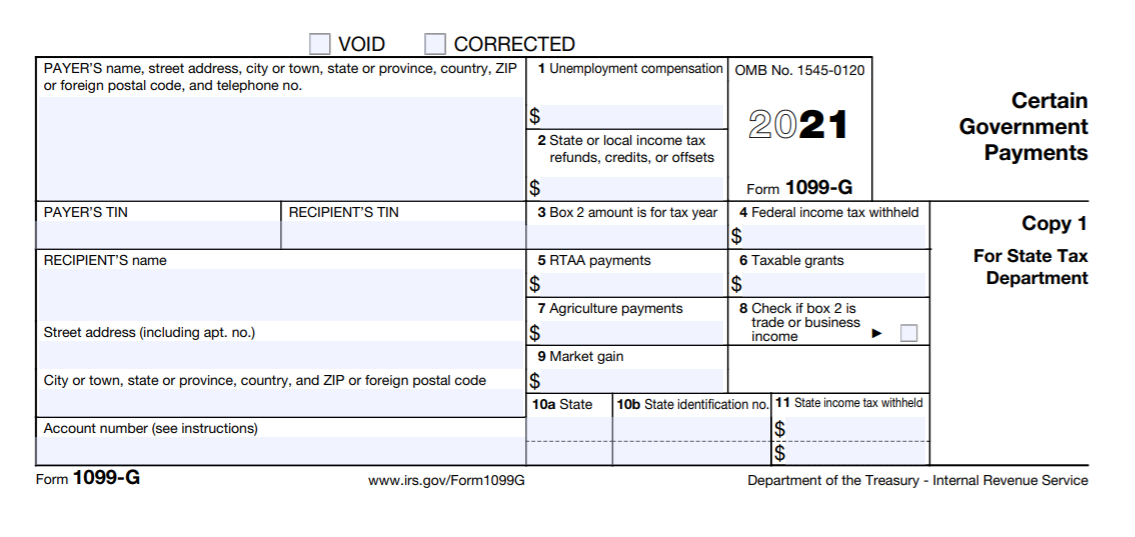

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Taxes On Unemployment Checks May Surprise Some

Doordash 1099 Taxes And Write Offs Stride Blog